How We Determine Your Gold & Silver jewelry & bullion Value & make a cash Offer in Edmond OK & Oklahoma City: A Transparent Step-by-Step Guide

- dadbeh j

- Jan 11

- 5 min read

If you’ve never sold gold or silver before, the process can feel unclear—especially when you hear phrases like “percentage of spot price,” “percentage of melt value,” “14 karat,” or “925.” At GoldSilverBuyerOklahoma.com, we believe you should understand exactly how your offer is calculated, and you should be able to watch the evaluation process from start to finish.

At a glance: what your offer is based on

Most gold and silver items are valued primarily on:

What the item is marked as (gold karat mark or silver mark)

How much it weighs

The current spot price (market price benchmark)

Our payout percentage of spot (to cover expenses and a reasonable profit margin)

Refining and processing costs (what it costs to turn scrap into tradable metal)Below is our step-by-step method for evaluating gold, silver, and other precious metals, along with the key factors that influence your final offer.

Step 1: We only consider items that are clearly marked

To be considered for purchase, items need to be stamped/marked.

Common gold markings we consider

10K, 14K, 18K, 22K, 24K

Numeric equivalents such as 417, 585, 750, 916, 999

Common silver markings we consider

925, STER, Sterling

Some items may be marked 800 however we do not buy 80% silver

Bullion may be marked 999 or 9999

If an item is not marked, we typically do not consider it. This avoids confusion, protects both parties, and keeps the process quick and consistent.

Step 2: We sort items by mark and type to keep the math clean

Next, we group your items so they’re priced correctly:

10K gold together

14K gold together

18K gold together

24k gold bars and gold bullion together

Sterling silver (925) together

.999 silver bullion together

This matters because each mark corresponds to a different precious-metal content percentage.

Step 3: We weigh the items accurately (weight drives value)

Weight is the backbone of precious-metal pricing.

Common units you may see:

Grams (g) (often used for jewelry)

Troy ounces (ozt) (standard in precious metals markets)

If you want the conversion explained, we will walk you through it plainly.

Step 4: We reference the spot price (the market benchmark )

Spot price is the benchmark market price for pure gold or silver (24K gold / .999 silver). and we derive our spot price from one of our refinary partners such as elemetal.com or dillongage.com

Most consumer items are not pure (for example, 14K gold is not 24K.14k gold is 58% gold along with other metals such as copper or silver). That’s why marks matter—your item’s marked purity determines the fine-metal content used in the calculation.

for example

10k or 417 = 41.7% pure gold content

14k or 585= 58.3% pure gold content

18k or 750= 75% pure gold content

21k or 875= 87.5% pure gold content

22k or 916=91.6% pure gold content

Step 5: We calculate the base metal value from the mark and weight

The core idea is:

Marked Purity × Weight × Spot Price = Base Metal Value (before payout percentage and not what you should expect from a for profit business)

Purity examples (based on common marks)

10K gold = 10/24 = 41.67%

14K gold = 14/24 = 58.33%

18K gold = 18/24 = 75%

Sterling silver (925) = 92.5%

Step 6: We pay a percentage of spot (and we explain why)

This is the part many sellers appreciate when it’s explained clearly.

We do not pay “100% of spot” because real-world buying has real costs, such as:

Operational costs (staff time, rent, security, equipment)

Compliance and recordkeeping requirements

Payment processing and banking costs

Shipping/handling of metals to a refinary and downstream processing costs

Market risk (spot price can move)

A reasonable profit margin (we are a for profit business)

So instead, we pay a percentage of spot that reflects the realities of the industry while still being fair and consistent.

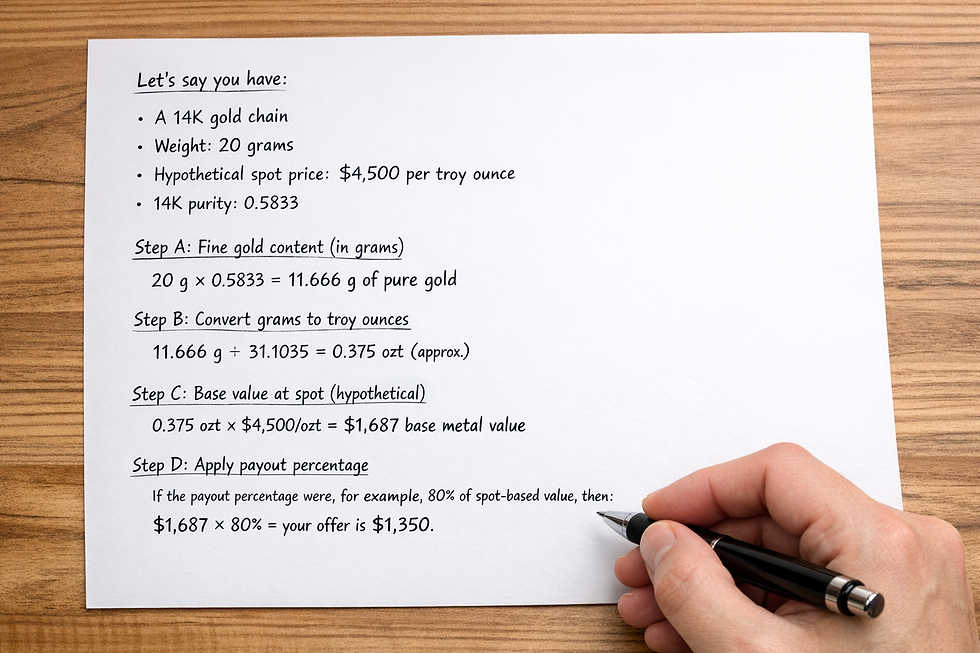

A simple example (hypothetical numbers)

Let’s say you have:

A 14K gold chain

Weight: 20 grams

Hypothetical spot price: $4,500 per troy ounce

14K purity: 0.5833

Step A: Fine gold content (in grams)20 g × 0.5833 = 11.666 g of pure gold

Step B: Convert grams to troy ounces11.666 g ÷ 31.1035 = 0.375 ozt (approx.)

Step C: Base value at spot (hypothetical)0.375 ozt × $4,500/ozt = $1,687 base metal value

Step D: Apply payout percentageIf the payout percentage were, for example, 80% of spot-based value, then:$1,687 × 80% = your offer is $1,350.

We will always explain the numbers we’re using so you understand how the offer was reached.

Step 7: You decide—no pressure

Once you see the offer and understand how it was calculated, you can choose to:

Accept and sell, or

Decline and keep your items

There is no requirement to move forward.

Final step: Verification happens only after you agree to sell

Because we are not a free testing facility, we reserve any verification step for the final stage of the transaction, after you’ve agreed to sell based on the marked purity and our calculation.

Why this exists:

It protects you from mistakes

It protects us from buying items that are not consistent with their markings

If something does not align with the item’s marking during final verification, we may:

Decline the purchase of that specific item, or

Recalculate the offer for that item before completing the transaction

This is not meant to be complicated—it’s simply how a responsible purchase is completed.

What you can do before you visit (so everything goes fast)

To keep your visit efficient:

Bring items that are clearly marked (10K/14K/18K/925/.999, etc.)

If possible, separate gold and silver into different bags

Bring any bullion packaging you have (if applicable)

Don’t worry about broken items—marked broken jewelry is still considered

Frequently asked questions

Do you buy unmarked gold or silver?

In most cases, no. Items need to be marked for us to consider them.

Do you pay extra for certain brands or special items?

No. We keep pricing consistent by paying a percentage of spot based on marked purity and weight.

Why does payout use a percentage of spot?

Because buying precious metals includes real business expenses and risk, and we also must operate with a profit margin to stay in business.

Ready to get a straightforward offer in Oklahoma?

If you have marked gold or silver you’d like to sell, we’ll walk you through the pricing clearly: mark + weight + spot + percentage. No gimmicks, no pressure.

When you’re ready, contact GoldSilverBuyerOklahoma.com 833-652-4653 or stop by at 711 S broadway, edmond OK and we’ll help you understand what to bring and what to expect.

Comments